- QUICKEN BILL PAY REVIEWS GOOGLE FULL

- QUICKEN BILL PAY REVIEWS GOOGLE SOFTWARE

- QUICKEN BILL PAY REVIEWS GOOGLE PROFESSIONAL

*Be sure to check with your bank, as some charge a fee for billpay if you don't maintain a minimum balance. I have used Quicken for Windows for over 25 years and have used Bill Pay for at least 15 years and the overall the experience has been very good, and Bill Pay was. But I'm looking to save money, and every little bit counts.

QUICKEN BILL PAY REVIEWS GOOGLE SOFTWARE

QUICKEN BILL PAY REVIEWS GOOGLE FULL

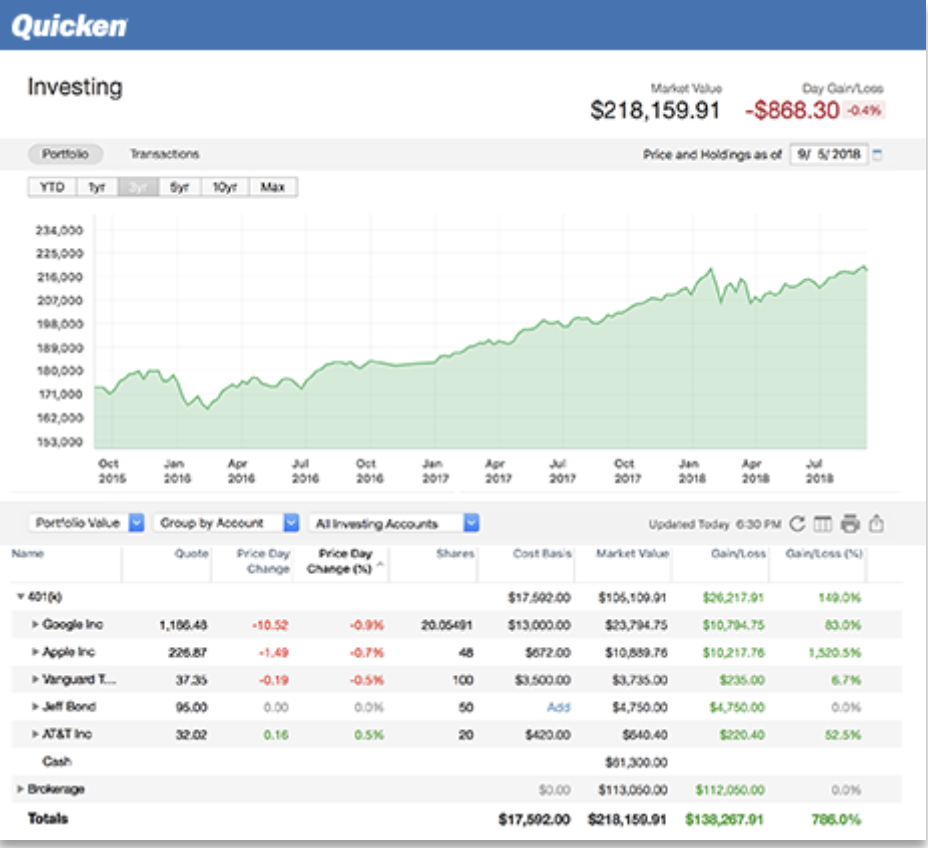

As I discussed in my reviews on Mint and YNAB, financial trackers can help you get a better idea of your full financial picture from one location. Quicken, for example, has over 17 million customers. I decided to give them a try, but after a month I couldn't use the service anymore. Together, they’re one of the world’s largest financial software providers.

Not only is the service and user interface horrible, but they are blatant thieves.

QUICKEN BILL PAY REVIEWS GOOGLE PROFESSIONAL

The company provides easy step-by-step instructions written in plain English, making it easy for users with limited professional legal knowledge to create DIY legal documents.

While I could authorize individual payees to access my account and take the funds, or use software such as Quicken or an online bill aggregator like M圜heckFree, here's why I prefer the bank route. Nolo will maker is among the oldest and most popular online legal websites that exist today. Always be prepared to provide your banking information and mortgage account number. The process is usually clear-cut, once you call the phone number, you will be instructed to follow directions. The phone number of your lender will be located online and on your monthly bill. But when I can't, I use my bank's online billpay feature. If that happens, paying your mortgage by phone can ensure on-time payment. When I can, I like to use my credit card so that I can earn points. In an effort to streamline my finances, I've been looking for a way to simplify paying my bills (because, unfortunately, not paying them isn't an option).

0 kommentar(er)

0 kommentar(er)